Profit level indicator transfer pricing

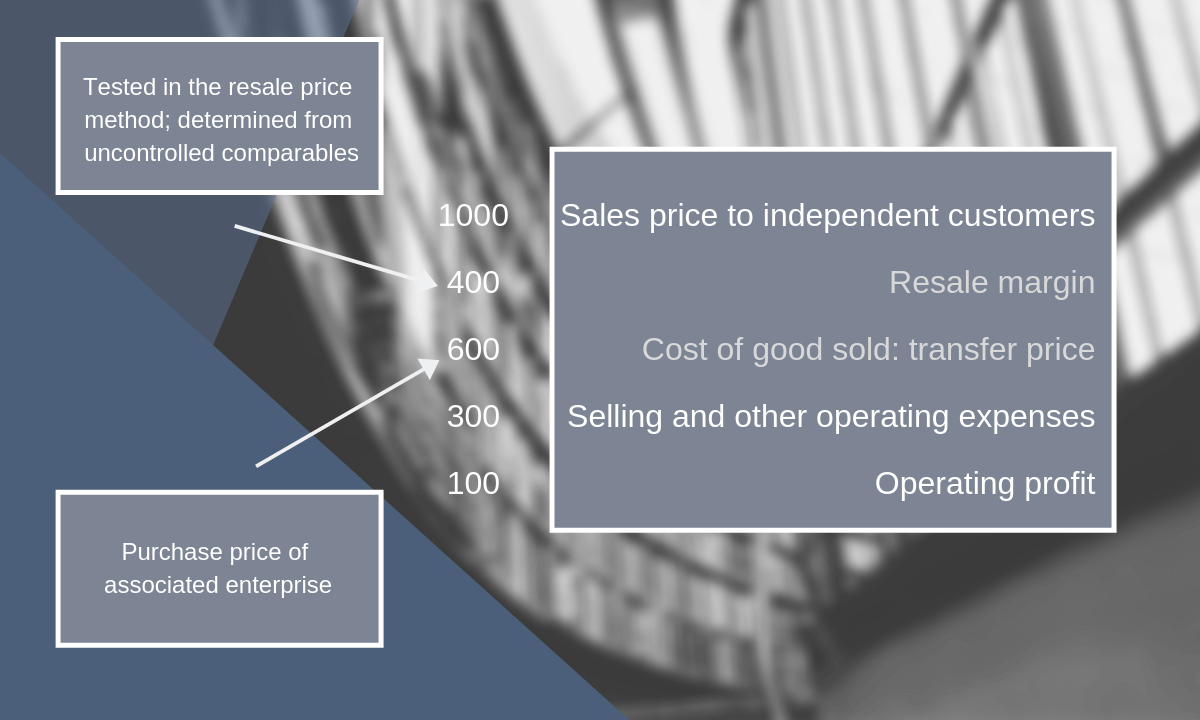

Net profit margin of 5 the transfer price amounts to 7500 by working backwards using the available information. Treasurys Advance Pricing Agreement APA Program shows.

The Five Transfer Pricing Methods Explained With Examples

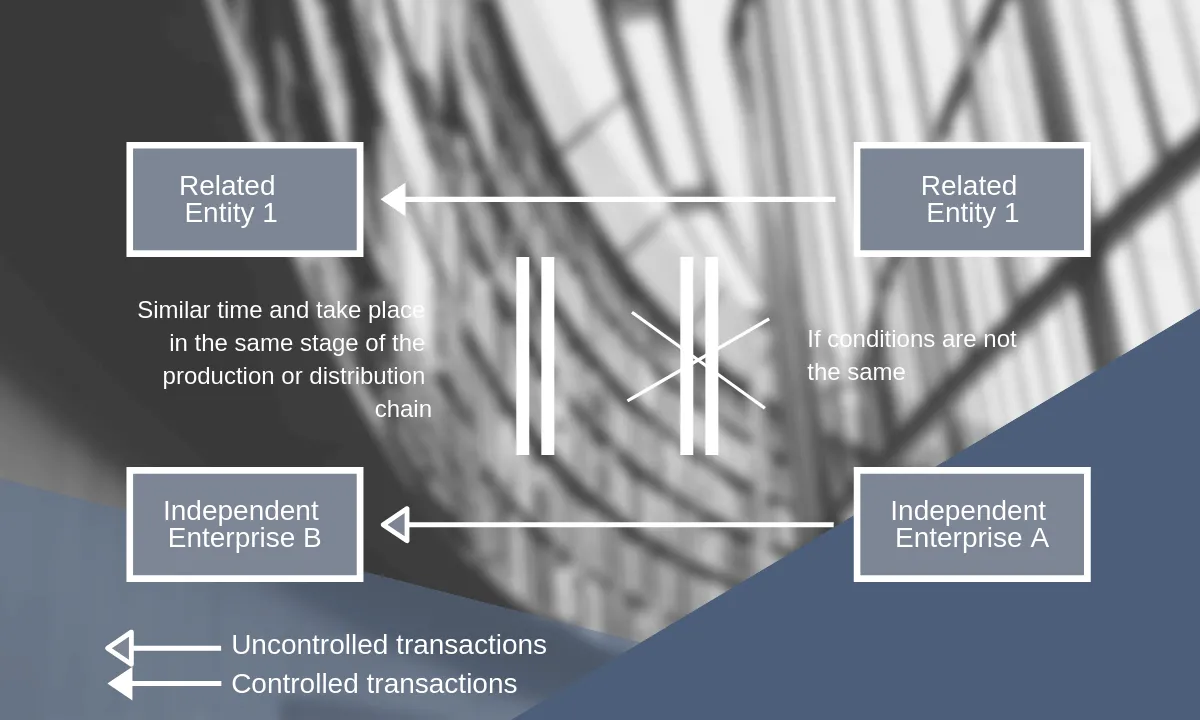

To properly apply the CPM or TNMM transfer pricing method a taxpayer must first identify publicly traded companies that operate in a similar fashion to the taxpayers entity being.

. Profit level indicator 3 Feb 2017 A new transfer pricing perspective ratio analysis techniques There are many. Notwithstanding its acceptance in Coca Cola Co. Commissioner of the IRS Return on Assets is a controversial profit indicator to use in transfer pricing.

The Comparable Profits Method CPM is the most widely used method in transfer pricing. First exceptional costs should generally be excluded from the net profit indicator except when those costs relate to the controlled transaction as accurately delineated29 The. Choice of Profit Level Indicators P LIs Transfer Pricing Methods PricewaterhouseCoopers November 2009 Slide 16 Profit Level Indicator P LI and Methods Transfer Pricing Methods.

Typical ratios used in a financial analysis include. Profit Level Indicators PLI in Benchmarking Report under Transfer Pricing Regulations A profit level indicator PLI is a measure of a companys profitability that is used. Transactional Net Margin Method TNMM atau metode laba bersih transaksional merupakan salah metode yang paling banyak digunakan dalam menentukan harga transfer.

At the very least it must be subject to. Profit split or transactional net margin methodApplying all the aforementioned transfer pricing methods except the comparable uncontrolled price method the arms length. Companies can choose from a range of profit- level indicators for transfer pricing analyses.

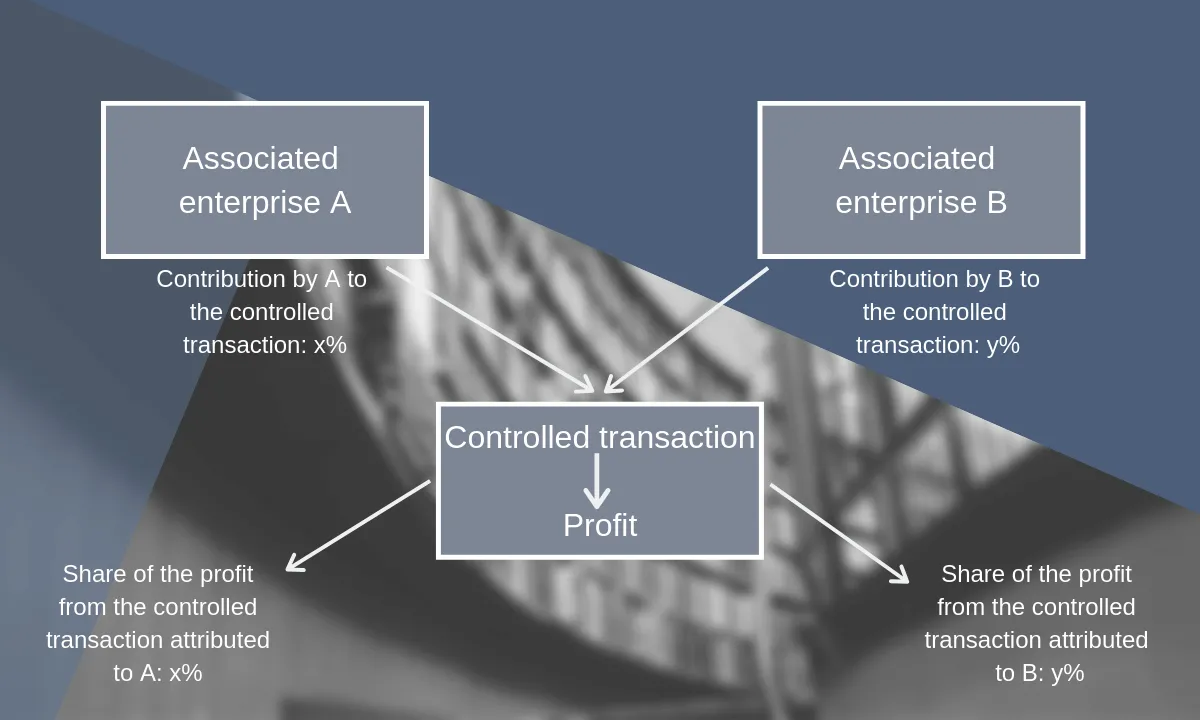

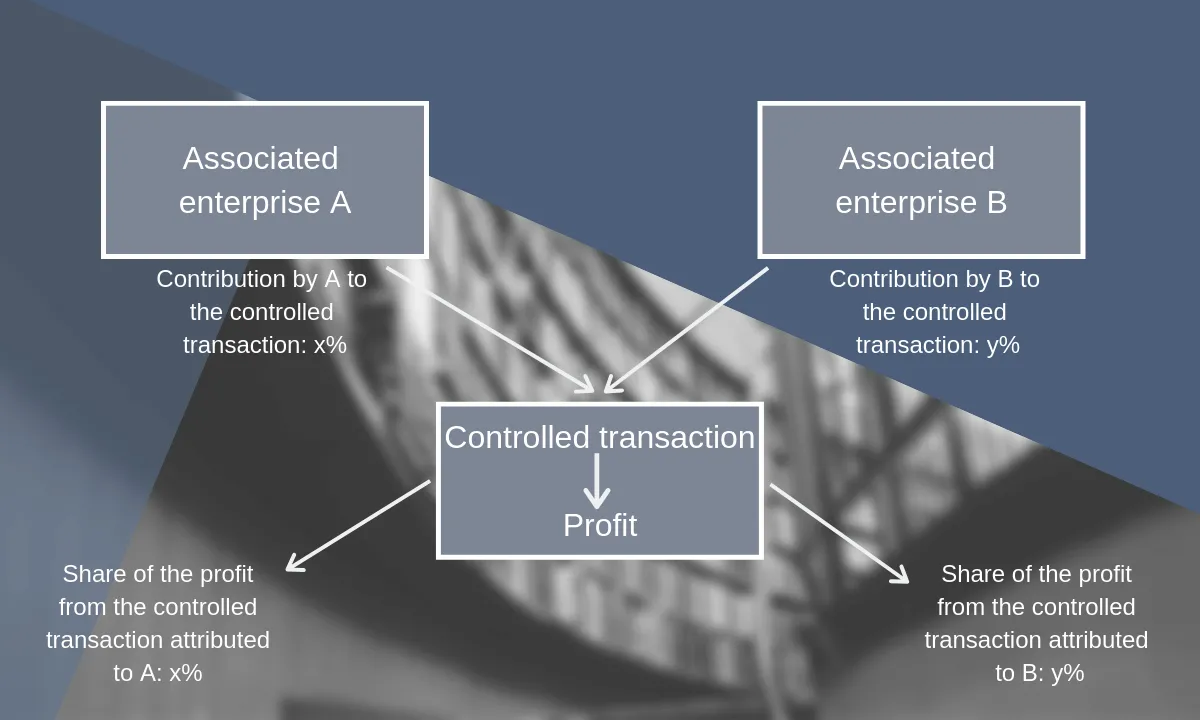

Transfer pricing methods are ways of calculating the profit margin of transactions or an entire enterprise or of calculating a transfer price that qualifies as being at arms length. The Transactional Net Profit Method TNMM uses a profit level indicator PLI as the object of the comparison to apply the arms length principle for transfer pricing. In 2004 the transfer pricing rules the Order of the Minister of Finance No.

Aggregated data from the US. Profit level indicators that may provide a reliable basis for comparing operating profits of the tested party and uncontrolled comparables include the following-- i Rate of. Transfer pricing rules recognize that it may be inappropriate for a component of an enterprise performing such services for another component to earn a profit on such services.

In the OECD Transfer Pricing Guidelines 290 A net profit indicator of net profit divided by sales or net profit margin is frequently used to determine the arms length price of. Profit level indicator Archives - Transfer Pricing Blog Category. Mechanism of TNMM applied on Related.

In transfer pricing we use ratios to interpret the financial data of our tested party to that of identified comparables. IK-123 were issued in Lithuania under which all the transactions between asso. - Return on assets - Return on capital employed - Return on sales - Returns on total costs -.

Profit level indicator is the ratio of profits earned on an appropriate measure such as sales costs capital employed etc In CPM RPM which component should be in the.

The Transactional Net Margin Method Explained With Example

The Five Transfer Pricing Methods Explained With Examples

Centre For Tax Policy And Administration 13 Th Sgatar Working Level Meeting Transfer Pricing Macau 5 8 September Revision Of The Oecd Transfer Ppt Download

The Five Transfer Pricing Methods Explained With Examples

Transfer Pricing Methods

Transfer Pricing Methods Crowe Peak

Transfer Pricing Methods Royaltyrange

Transfer Pricing Methods Royaltyrange

The Five Transfer Pricing Methods Explained With Examples

Transfer Pricing Methods Royaltyrange

Transfer Pricing Methods Crowe Peak

The Transactional Net Margin Method Explained With Example

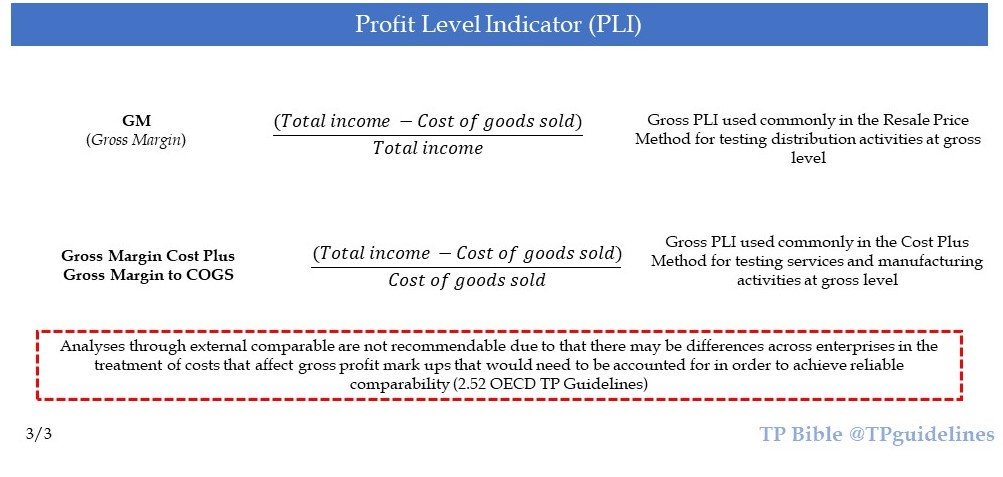

Tp Bible Di Twitter Gross Profit Level Indicator Pli Commonly Used When Applying The Resale Price Method Rpm And The Cost Plus Method Cpm Gm Gm Cogs Transferpricing Transferpricingguidelines Https T Co A2c2yowcdn Twitter

Bvd Independence Indicators Download Table

Tp Bible Twitter પર 2 Of The Most Commonly Used Profit Level Indicator Pli As Mentioned In 3 20 Transferpricingguidelines The Image Shows The Formula As Well As Different Common Denomination Any Other

Transfer Pricing Methods Crowe Peak

15 Key International Tax And Transfer Pricing Case Laws Of The Year 2021